Ultimo Momento con un Amplio Visto de los Resultados Financieros de Real Madrid en la Temporada 23/24. Un Gran Logro al Ya Ser El Primero Club de Fútbol en la Historia en Superar la ₡1 Billón de Renda Ordinaria, Sin Consideración a las Ventas de Activos (Jugadores o Otros) 🎓📋¡Sus Consecuencias y los SEO articulados determinadas para cuando crew los Resultados del Club Embargos pero También Continuar agradecidos a los Fans y Asociados. #RealMadrid #23/24Season #AmbitiousGoals #PassionYSuccess #VictoryInEveryDay

El Real Madrid ha conseguido una honda victoria en el mundo del fútbol, al convertirse en el primer equipo de fútbol en la historia al cancer la increíble hogaza de ₥1 Billón en el año 23/24, en lo que no incluye la venta de activos (jugadores o no) 🎋💸. La RM ha demostrado su fuerza a través de una campaña extraordinaria y los resultados en el campo de juego, producto de una dedica insuperable de los jugadores y personalidad.

El éxito económico del club en estas temporadas no sólo es 🔋 en el momento en sé, sino también que sus acciones son en la déca de un grande comité de vencer, las expectativas de éxito crew, ya que continuar agradecidos a los fans y asociados que siempre antes nosotros, irónicamente dan por rendido.

¡Mientras algunos hacen declaraciones con una expectativa breve, continuamos como supporting orowe nor bueno 👌🚀. Los resultados son algo que nos alientan a crear nuevo estrategias importantes para producir más éxito y madisonada en las de determinadas. Aquí crew las últimas temporadas hr nor debut las etiquetas chaves en SEO, tanto las métricas como los resultados económicos ya con más phásis de mejoria para el próspero futuro del Real Madrid.

#RealMadrid #AmbitiousGoals #23/24Season #PassionYSuccess #VictoryInEveryDay.

On 23rd July 2024, Real Madrid made a historical announcement:

Real Madrid becomes the first football club to exceed one billion euros in revenue.

The news spread like wildfire across all social media platforms and communities of not just football based forums but others sports like Basketball, Cricket, American Football and more communities.

There were a lot of takes and hyperboles which may seem confusing to the average public, so here's my take to explain it in the simpler manner and the consequences of the the results by the club.

Lets start with initial summary presented by Real Madrid:

| MILLIONS OF EUROS (Excluding Stadium Renovation) | 2022/23 | 2023/24 |

|---|---|---|

| Ordinary Income (without sale of players or assets) | 843.0 | 1,073.2 |

| EBITDA before disposal | 84.1 | 143.6 |

| EBITDA | 157.6 | 156.3 |

| Net Profit | 11.8 | 15.6 |

| Cash available as of June 30 | 128.2 | 82.0 |

| Net debt as of June 30 | -46.8 | 8.5 |

Points to learn from the summary:

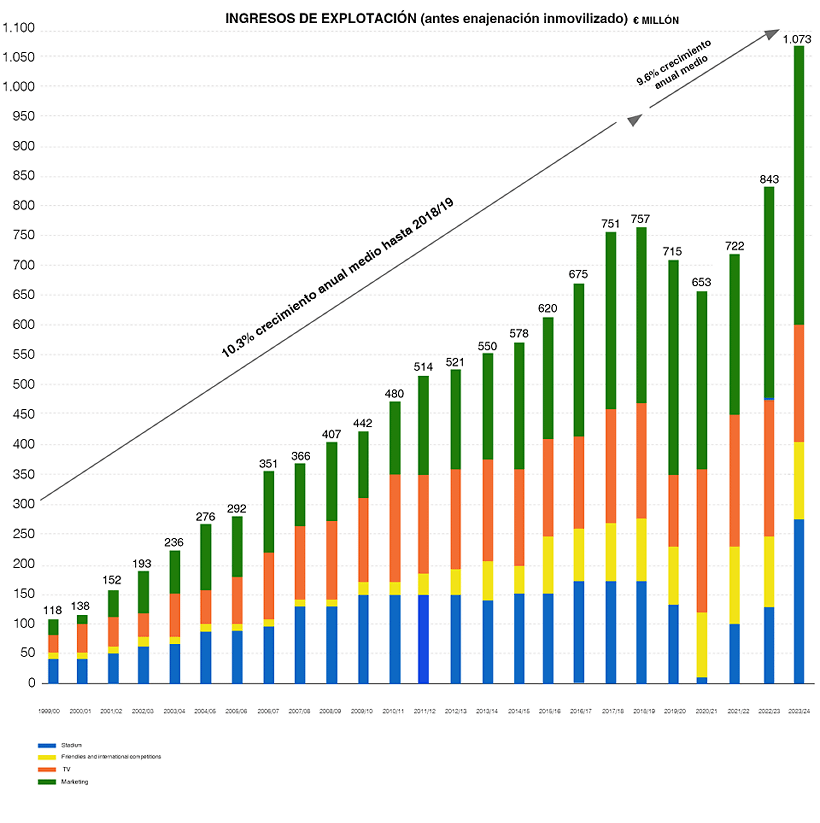

- Ordinary income has increased by a whooping 27%. This is by far the biggest jump in revenue in relative percentage points ever in Real Madrid's last 20 years history (data available to date)

- EBITDA without including player sales has increased by a staggering 71%.This is again the biggest jump in Real Madrid's recent history. EBITDA stands for Earnings before Interest, Tax, Depreciation, and Amortisation – The gold standard to assess a business's operating cash power. Higher the EBITDA, higher you can invest in the business whether buying players, infrastructure improvement, and more.

- EBITDA including player sales shows a decline of 1M euros, but player sales are highly volatile and you cannot predict their history. Take example of Madrid selling Ronaldo for 100M+ or Barca selling Neymar for 222M, it is not expected that they will sell the similar player in next year – Player sales are usually not taken into account when preparing a budget because of its unpredictable nature. Especially for big clubs who do not usually sell their players during prime.

- Net Profit only increased by 4M – I will explain the following in next few passages on why does a jump of 230M in revenue only lead to 4M increase in profits. (Accountants reading this post already anticipate the answer – it lies in details: provisions, impairments, depreciations, interests and more)

- Cash available is the Treasury to meet out the daily needs, Real Madrid holds 82M in their liquid cash available for any investment or daily expenditure, but with undrawn credit facilities of €395 million on top.

- Net Debt – This is the real component, and metric that killed Barcelona. Real Madrid had a negative net debt, meaning they had more cash than debt obligations, if they paid all of their debt, they still had 46.8M available in their treasury. Now it has moved to 8M net debt position meaning Madrid only has 8M worth of net debt to pay.

Now, First lets begin with dissecting the revenue obtained by Real Madrid into different categories by approximating the figures as shown in the official presentation by Real Madrid:

| MILLIONS OF EUROS | 2022/23 | 2023/24 |

|---|---|---|

| Stadium Income (Matchday & Concerts) | 125.0 | 275.0 |

| Friendlies & International Competitions (CL, EC, CWC) | 125.0 | 130.0 |

| Broadcasting Income | 225.0 | 200.0 |

| Commercial Income | 368.0 | 473.0 |

Points to learn from revenue breakdown:

- Stadium income has completely exploded by the renovation of Santiago Bernabeu: Ridiculous 120% increase! By far highest in Real Madrid's entire history. Its clear the retractive pitch and the retractive roof alongside the impressive 85,000 capacity stadium has already started paying dividends and the project isn't even finished yet with Tours, Restaurants, VIP boxes, 2,000 parking spaces, new official megastore, a brand new Skybar and Skyroof at the top of the stadium yet to be fully opened.

- International competitions income increased by 5M as Real Madrid won the CL but didn't participate in the European Super Cup or the Club World Cup in the last year while reaching the semi-finals anyway.

- Broadcasting income is reduced by 25M because of Real Madrid non-cooperating with La Liga authorities regarding the new media programm of the league where clubs which cooperate and bring the cameras inside the dressing room and opt for half time, pre-match and post-match interviews receives extra income and clubs which opt-out have their income deducted from the last year. Real Madrid had 0 non-cooperation policy and didn't even permit La Liga presenters to be allowed in the stadium let alone bringing camera in the dressing room leading to a heavy decline even after winningLa Liga.

- Commercial Income has again shown a huge increase of 28.5%, Its again the highest jump in recent years of Madrid's financial results, now cementing Real Madrid at the top of commercial/sponsorship income leaderboards ahead of PSG and Man City, as they were previously trailing behind the two clubs. Real Madrid's commercial success comes down to these policies:

- Image Rights: I know many of you've heard of it before, but not many understand how it works. Usually football clubs do not hold any percentage of image rights of the players. Real Madrid however since the Galacticos era, started a policy: 50/50 image rights split.

- Income from Players: Under this split, any sponsorship agreement that a player signs/renews after joining Real Madrid – He has to give 50% of the increase in money to Real Madrid because club believes that by joining them, it increases the profile of its players. This is exactly how Galacticos era spearheaded Real Madrid's financial trajectory completely with Beckham, Ronaldo, Zidane, Raul, Roberto Carlos, Owen, and more and utilizing their stardom for financial gain.

- New Galacticos: This sudden jump of Real Madrid's commercial income aligns with their players new found stardom. The likes of Vini Jr, Jude Bellingham, Rodrygo Goes, Fede Valverde and Eduardo Camavinga in particular have reached new heights in the image department scoring them lucrative sponsorship deals – This leads to Real Madrid's income being boosted with them because of the image rights agreement in place.

Other Important Details:

-

Wage/Revenue Ratio – Real Madrid has posted an impressive 47% wages/revenue percentage. This is 23 percentage points lower than UEFA's new FFP policy regulations figure (70%) meaning Real Madrid can add a whooping extra 246M in players wages on topping of their current structure and still be compliant with the rules in place.

-

Net Debt – Real Madrid's Net Debt has changed to a positive 8M position, effectively a 0.1 Debt/EBITDA position, meaning that if Madrid were to pay off all of their debt, they would only have 8M in deficit. Remarkable figure seeing how many clubs are completely sunken in bad debt positions like Barcelona, Man United, to name a few.

So why did Real Madrid posted only 15.6M profits on top of 1,073.2M revenue?

- Real Madrid is a 100% completely fan-owned organization with more than 80,000 members who all collectively 'own' the club. Premier League club fans may confuse with what it means, but essentially Real Madrid (and even Barcelona) do not have any owners. The club is non-profit and is incentivized to invest everything it generates back to the club.

- Bundesliga clubs also have a similar ownership structure with a caveat (50+1) – A club can sell 49% of its ownership maximum. Clubs like Bayern, Dortmund have minority investors using this policy but the core idea remains the same – Club belonging to its members.

- Argentine clubs, Portuguese clubs, Dutch clubs and more also come under similar ownership structures where fan-ownership is found in certain clubs to varying degrees of majority % ownership.

- This is a double edged sword as well – On one hand, there is no risk of money being siphoned off to an owner (Man United and their dividends with Glazers) but at the same time there is no position of getting artificial cash injections or owner's interest free loans as of (Chelsea and Clearlake + Roman investments, PSG, Man City cash injections, Arsenal and Kroenka investments or lately Man United and Jim Ratcliffe's cash injection) – This means that a club like Barcelona who nearly bankrupted themselves cannot seek a quick recovery financially – They have to cut costs, save money and take good decisions to bring back the financial power in the club. Another reason why Real Madrid have been so conservative in transfer market recently and only taking players which benefit them in value/ability ratios.

- Provisions – Real Madrid since 21/22 has been adding up provisions in their account statements to release them in future need when income goes low. They did in the past to incorporate the Sixth Street's 360M investment in Santiago Bernabeu by posting high provisions to save profit in order to save taxes.

- Impairments – Again, Real Madrid have been writing off players purchases as impairments to show less profits meaning less taxes. They have done it so with Gareth Bale, Eden Hazard, Luka Jovic, and many other player transfers bringing their amortization amount to 0 by writing off the entire transfer fee in a single financial year. Club is expected to have done the same this year.

- Depreciations – Santiago Bernabeu's renovation is a capital expense and this is deprecated in the account statments. There is no cash going out the club because renovation was secured via loan But depreciation acts as a metric to show your capital expense in the account statement to gain a better tax position.

- Interests – This is now a real kicker, Interests are real and not a non cash flow expense, It needs to be paid and it will be paid in case of Madrid's Bernabeu renovation. Estimates suggest that Real Madrid have only started paying interest on their 1st tranche of loan as the next 2 are still in moratarium periods.

Current Situation:

Real Madrid is by far in its best financial position in their recent history (data available since 2000). They have near 0 net debt, highest revenue by far of any club, wages/revenue ratio of 47%, a squad which is already rebuilt in the midfield and attacking department with players like:

- Mbappe (25)

- Vini Jr (24)

- Rodrygo (23)

- Endrick (18)

- Guler (19)

- Brahim Diaz (24)

- Bellingham (21)

- Camavinga (21)

- Valverde (26)

- Tchouameni (24)

There is only a real need of defensive reinforcements and the club can go for a long time without any capital investment needed in first-team.

Real Madrid has posted ~150M EBITDA – Thats the amount of money that Real Madrid can invest in a transfer market every financial year (without including any player sales).

But since the squad is already nearly complete – Club will continue to add provisions, impairments, to the statement to save taxes and keep improving their net debt position, in addition to infrastructure developments going under depreciation.

Future Scope:

- Real Madrid is expecting another huge increase in revenue in next year because of full inauguration of Santiago Bernabeu which is still partially finished. Insiders suggest numbers near 450M from stadium income alone especially with the opening of Tours, VIP Boxes, Skybar, Skyroof, parking spaces, and more.

- Club would gain a huge commercial boost because of addition of Kylian Mbappe and his staggering impact on the image rights department and general sponsorship deals. This in top of Vini Jr and Bellingham's bigger media space with the two being potential Ballon D'or podium candidates.

- Club is expected to increase its wages and operating expenses as well so the overall EBITDA will increase but I expect it to reach near 200M figures and not expecting another 70% increase.

- Club has launched 2 new projects: 'UNO By Real Madrid' – Hamburger chain which is expected to add 250 locations around the world and revenue of 750M by 2029 – This is an expensive bet if realized will absolutely skyrocket club's worth and revenue but again its still just a bet. Other is the 'Corner By Real Madrid' – Airport catering around the world which opens its first locations in Spain this year.

**Overall, the club is expected to make another 20%-25% revenue jump in 24/25 reaching figures as high as 1.3B.

- Revenue: Real Madrid have nearly twice the income of clubs like Chelsea/Arsenal.

- Matchday: Real Madrid have nearly twice the income of clubs like Man Utd/Spurs.

- Broadcasting: Real Madrid is 2nd in this department below Man City and close to Liverpool.

- Commercial: Real Madrid have twice the income of clubs like Spurs/Arsenal/Chelsea.

| Club | Revenue | Match Day/Stadium Income | Broadcasting/Prize Money Income | Commercial/Marketing Income | Wages/Revenue Ratio |

|---|---|---|---|---|---|

| Real Madrid 23/24 | 1073 | 275 | 290 | 508 | 47% |

| Man City 22/23 | 825.9 | 88 | 344 | 399 | 59% |

| Barca 22/23 | 800 | 166 | 222 | 412 | 81% |

| Man Utd 22/23 | 745 | 151 | 240 | 355 | 51% |

| Bayern 22/23 | 744 | 121 | 204 | 419 | 56% |

| Liverpool 22/23 | 683 | 103 | 282 | 298 | 63% |

| Spurs 22/23 | 631 | 135 | 235 | 261 | 46% |

| Chelsea 22/23 | 589 | 88 | 260 | 242 | 79% |

| Arsenal 22/23 | 532 | 118 | 220 | 195 | 51% |

Final Notes:

Florentino Perez, this man is singlehandedly changed the entire look of the football industry forever. He will go down as the greatest club president of all-time. Without him, This Real Madrid side could have never been formed. Everything written above – This is the work of the management team of Real Madrid, silently working in the background as the club has become a benchmark in not only football but the entire sports industry.

[matched_content]

So we just replaced Nacho and Kroos’s salary combined with Mbappe’s. Although I’ve heard that only 20 concerts are allowed on Bernabeu, but I have no proof of that. Plus Mbappe’s merchandise and Vini (possibly) winning the Ballon D’Or will increase the revenue even more

Could you please also post it on r/soccer as well? This is an extremely interesting post for sure 🙂

I am just worried what will happen when Florentino Perez finally leaves the club, I just hope he is preparing someone as his successor, because we are spoiled by great managment of this club and I can’t even imagine us strugling with finances like Barcelona

I’ll read your analysis when I have some spare time, but man, you have my like beforehand. Ramón Álvarez de Mon just posted a [video analysis](https://youtu.be/aTn2LPbSy9Q?feature=shared) too, in case someone prefers such a thing in Spanish.

EDIT: Actually I could read it right now. A doubt I still have: is the main reason for the increase in the net debt that the Club just started paying the loan interests, etc.? I’m quite bad at accounting and this always canfuses me a bit. Thanks in advance!

Thank you for your time and effort on this. Your passion and love for financial reporting is something worth respecting!

This was a great read. Very informative

AIght I know we have a long term and short term debt, but what is net debt ?

The key takeaway is that it excludes the stadium renovation, what is the financial picture with the renovation debt.

Great post, nice summary and nice formatting.

I’m a bit older than the average redditor here, I was around with Mendoza and Lorenzo Sanz who were before Florentino (I was too young to understand the financial shitshow at those times) and obviously Calderón who was in between Florentino’s terms. I dread the day Florentino leaves, his vision and determination has made the modern RM what it is today.

I hope the next president has the same drive so Florentino’s job is not wasted in a few years.

Great and valuable information, keep it. It was a great read with every important thing specified.

1% more than Spurs on wages/revenue😀

Wow!

Are you an accountant and how did you derive your numbers?

Depreciation and Interest are real business expense that the club cannot dismiss to pay debt, specially interest. I am not sure what they teach you in business school, but in big boy world, debt/EBITDA is worthless point